Managing a budget doesn’t have to mean wrestling with complicated formulas or switching between multiple tabs. The budget spreadsheet template for Google Sheets by Sheetrix is a single-sheet budgeting system designed to keep everything visible, organized, and easy to update.

This template helps you track income, expenses, and savings in one place. Instead of juggling separate sheets or apps, you can view your Budget Summary, Category Breakdown, and Transactions all side by side. It’s clean, fast, and ideal for anyone who wants to understand where their money goes without overcomplicating things.

Whether you’re a student trying to stretch your monthly allowance, a freelancer balancing multiple income streams, or a household tracking expenses together, this template offers a straightforward way to stay in control. It works in both Google Sheets and Excel, so you can pick whichever platform you prefer.

Key Features and Sections

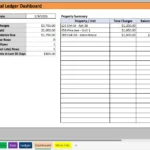

The template is divided into three main areas — Budget Summary, Category Breakdown, and Transactions — with an additional Dropdowns tab for customization. Each part has a clear purpose and updates automatically as you enter data.

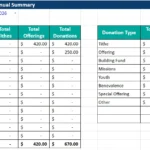

Budget Summary

This section gives you a top-level view of your financial situation. You’ll see total income, savings, and expenses, along with the remaining balance for the month. The difference columns automatically calculate how far over or under budget you are.

For example, if your “Income Source 1” is budgeted at $2,000 and you actually earn $2,500, the template will show a $500 surplus. If you spend $200 more than expected in expenses, the difference appears instantly so you can adjust next month’s plan.

Category Breakdown

Below the summary is a breakdown of all spending categories — such as Housing, Utilities, Groceries, and Transportation. Each category compares your budgeted amount to your actual cost, then calculates the difference automatically.

This is especially helpful for spotting overspending patterns. If your “Dining Out” category consistently runs over, you’ll know where to tighten your budget or adjust expectations.

The template includes space for notes next to each category, allowing you to add quick reminders like “holiday groceries” or “annual insurance payment.”

Transactions Table

On the right side, you’ll find a clear, color-coded transaction tracker. Each row captures a date, category, item name, cost, and payment method. The category column uses a dropdown menu linked to the Dropdowns tab, keeping your entries consistent.

When you record a new transaction — such as “Rent, $1,200, Cash” or “Groceries, $85, Credit Card” — the totals in your Budget Summary and Category Breakdown update automatically. There’s no need to manually sum or filter anything.

Dropdowns Tab

This secondary tab stores all your category and payment method lists. You can modify them anytime. If you want to track extra details like “Savings Goals,” “Freelance Projects,” or “Vacation Fund,” simply add those categories here. The dropdowns update instantly, and the main sheet keeps working perfectly.

How to Use the Template

Using the Budget Template is simple and requires no spreadsheet expertise. Follow these quick steps to get started:

- Open the template in Google Sheets (or Excel if you prefer).

Make a copy so you can edit your own version. - Set your monthly budget amounts.

In the Budget Summary and Category Breakdown sections, enter how much you plan to earn or spend in each category. For instance:- Income Source 1: $2,500

- Income Source 2: $600

- Savings Goal: $300

- Expenses Total: $3,000

- Income Source 1: $2,500

- Record each expense or income transaction.

In the Transactions area, type the date, category, item, cost, and payment method. Example entries might include:- 10/03/2025 – Groceries – $92.40 – Debit Card

- 10/10/2025 – Freelance Payment – $450.00 – PayPal

- 10/20/2025 – Gym Membership – $45.00 – Credit Card

- 10/03/2025 – Groceries – $92.40 – Debit Card

- Review your totals.

The summary and category breakdown update instantly. You’ll see your total actual income, expenses, and remaining balance. Any overspending appears as a negative difference, helping you react quickly. - Reset or duplicate for new months.

Once a month is finished, duplicate the sheet and rename it “November 2025 Budget,” for example. That way, you can track trends across months while keeping everything organized.

This process takes only a few minutes per week but gives you a powerful snapshot of your financial health at any time.

Tips for Customizing It

One of the best things about this budget template is its flexibility. You can easily customize it to match your goals or preferences.

For Google Sheets users:

- Use Data Validation to add new dropdown options without breaking formulas.

- Add Conditional Formatting to highlight negative differences in red and positive ones in green.

- Insert a simple bar chart or pie chart showing your top spending categories for a visual overview.

For Excel users:

- All formulas are compatible, but you can enhance it with Excel’s SUMIFS and TABLE tools for advanced summaries.

- Freeze the top rows so your headers stay visible as you scroll.

- If you prefer automation, turn your transaction range into an Excel Table so new entries auto-expand.

Add personalization:

- Rename categories to match your lifestyle — for example, “Childcare,” “Subscriptions,” or “Side Hustles.”

- Adjust currency symbols or date formats depending on your region.

- Use a consistent color palette (soft greens, blues, and neutrals work best) to make the sheet visually clean and pleasant to work with.

These small tweaks help you make the spreadsheet truly yours while keeping the structure intact.

Why Choose This Template

There are countless budget spreadsheets available online, but this one-sheet format from Sheetrix was built with real users in mind. It focuses on clarity, speed, and practicality.

Here’s why users prefer it:

- No clutter — all information fits in one view.

- No setup barriers — you can start tracking instantly.

- Perfect for sharing — ideal for couples, teams, or accountability partners.

- Works everywhere — compatible with both Google Sheets and Excel.

It’s also ideal for different user types:

- Students who want a simple monthly budget without formulas.

- Freelancers managing multiple income sources.

- Small business owners tracking operating expenses.

- Households wanting transparency in shared finances.

Instead of over-engineered dashboards, this layout gives you what matters — insight and control — in the fewest clicks possible.

Get Your Free Budget Spreadsheet

- Free Template

- Fully Editable

- Instant Access

- Organize your information

How to Access Your Copy

- Enter your email for instant access

- Open the link we send you

- Start using the spreadsheet right away

If you’re just starting out with spreadsheets, this is one of the easiest ways to get organized financially. It’s beginner-friendly but powerful enough for long-term use.