Running your own trucking business can be rewarding — but keeping track of every dollar in and out can feel like another full-time job. Between fuel receipts, maintenance bills, tolls, and permits, it’s easy to lose sight of how profitable each month truly is. That’s why we created this Owner Operator Trucking Expenses Spreadsheet — a powerful yet simple Google Sheets template designed specifically for independent truck drivers and small fleet owners.

With this free spreadsheet, you can manage income, expenses, and profit all in one organized dashboard. Whether you’re tracking one rig or a few, it gives you instant visibility into your cost per mile, net profit, and expense breakdown without complicated software.

What Is an Owner Operator Trucking Expenses Spreadsheet?

An owner operator trucking expenses spreadsheet is a customizable tracking tool built in Google Sheets or Excel that helps truckers monitor income from loads, fuel purchases, maintenance costs, and other operating expenses. Unlike basic logbooks, this template automatically calculates totals, generates monthly summaries, and provides charts to help you understand where your money is going.

This version is fully compatible with Google Sheets — so you can access it from anywhere, share it with your accountant, and update it from your phone or tablet on the road.

Why Every Owner Operator Needs an Expense Spreadsheet

Tracking expenses manually or relying on paper logs often leads to missed deductions, inconsistent reporting, and headaches during tax season. A digital spreadsheet makes record-keeping simple and consistent. Here’s what it helps you do:

-

Track every expense category automatically – fuel, maintenance, insurance, permits, meals, tolls, and more.

-

Record your income per load or trip – including miles, rate per mile, and client details.

-

See your real-time profit margin – instantly view how much you’re actually making after expenses.

-

Prepare for tax season – organized categories make it easy to hand off data to your accountant.

-

Identify high-cost areas – spot trends like rising fuel costs or frequent repair expenses before they impact profitability.

What’s In the Template?

The spreadsheet includes five main sheets, each built to simplify your record-keeping:

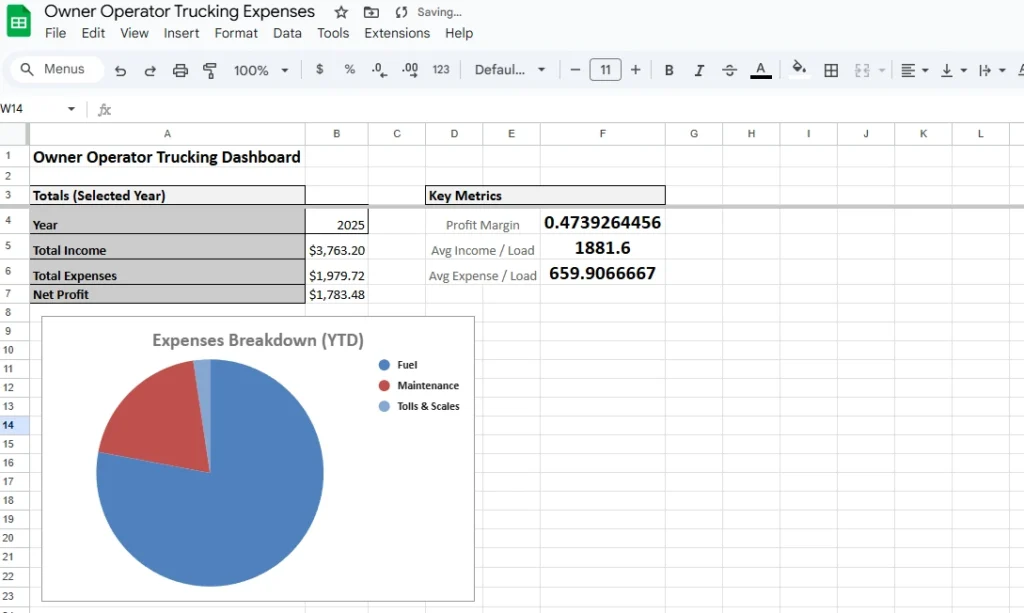

1. Dashboard

Your one-page business overview. See your total income, total expenses, and net profit for the selected year, plus a pie chart of expenses by category and a monthly profit trend chart. It automatically updates as you log data.

2. Income Tracker

Log every haul or delivery. Track:

-

Date

-

Load/Trip ID

-

Client Name

-

Origin and Destination

-

Miles Driven

-

Rate per Mile (auto-calculates Total Income)

-

Notes (for freight type, payment status, or details)

The sheet automatically computes total revenue and adds helper columns for Month and Year, allowing easy monthly reporting.

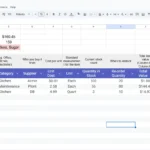

3. Expense Tracker

A detailed log for every cost your business incurs. Choose from dropdowns for:

-

Expense Category (Fuel, Maintenance, Insurance, etc.)

-

Payment Method (Cash, Card, ACH, etc.)

-

Vendor

-

Amount

-

Optional link to receipts or invoices

Each entry automatically links to your monthly and yearly summaries.

4. Summary Report

A clean monthly breakdown of:

-

Total Income

-

Total Expenses

-

Net Profit

-

Fuel Cost % and Maintenance %

This section includes auto-updating charts that visualize your profit and expense distribution, helping you make data-driven decisions throughout the year.

5. ReadMe & Data Lists

Instructions and built-in dropdown lists for categories and payment methods. It also includes SEO-optimized copy you can use for your own records or website.

Benefits of Using This Template

-

Saves Time: Log trips and expenses in seconds instead of hours.

-

Reduces Errors: Built-in formulas prevent double-counting or misentries.

-

Accessible Anywhere: Use it online or offline in Google Sheets.

-

Tax Ready: Organized categories match IRS-recognized expense types.

-

Customizable: Add your own categories or company logo for branding.

This sheet gives you the financial visibility of trucking management software without the monthly fees — ideal for independent operators who want full control over their data.

Typical Expense Categories Covered

-

Fuel

-

Maintenance and Repairs

-

Truck Payment

-

Trailer Lease

-

Permits and Licenses

-

Insurance

-

Tolls and Scales

-

Lodging and Meals

-

Office and Admin Supplies

-

Taxes and IFTA Fees

-

Safety and Compliance Costs

-

Communication (Phone, Internet)

Each of these is pre-loaded into the expense dropdown for consistent data entry.

Pro Tips for Owner Operators

-

Track by load, not just by month: This lets you calculate profit per mile or per client.

-

Add receipt links: Upload images of receipts to Google Drive and paste share links in the “Receipt” column.

-

Review trends monthly: Look for spikes in maintenance or fuel usage.

-

Back up your file: Save a copy each quarter for historical comparison.

-

Use filters: Sort by vendor or category to see where your biggest expenses occur.